Introduction

Traveling is exciting. You plan your trip, book tickets, and dream about new places. But trips do not always go as planned. Flights get canceled. Bags get lost. People get sick while traveling. This is where travel insurance becomes important. It protects you from unexpected problems during your trip. Think of it as a safety net for your travel plans. When something goes wrong, you do not lose all your money or peace of mind.

Many travelers skip travel insurance because they think it is expensive or unnecessary. In reality, it is affordable and very helpful. A small cost can save you thousands of dollars. From medical emergencies to trip delays, travel insurance covers risks you cannot control. This guide explains everything in simple words. You will learn what travel insurance is, how it works, and how to choose the right plan for your needs.

What Is Travel Insurance and How Does It Work

Travel insurance is a contract between you and an insurance company. You pay a small amount called a premium. In return, the company agrees to cover certain travel risks. These risks may include medical emergencies, trip cancellations, lost baggage, or flight delays. If a covered problem happens, you file a claim. The insurer then pays you back according to your policy terms.

Travel insurance works before and during your trip. Some coverage starts right after purchase. Other benefits apply once your journey begins. Policies differ by provider and plan type. That is why reading policy details matters. Good travel insurance gives peace of mind. You enjoy your trip knowing help is available when you need it most.

Why Travel Insurance Is Important for Every Trip

Many people believe travel insurance is only for international travel. This is not true. Even domestic trips can face problems. Bad weather, illness, or airline issues can ruin plans. Travel insurance protects your money and time. It helps cover non-refundable costs like flights and hotels.

Medical emergencies are another big reason. Health care abroad can be very expensive. Your local health plan may not work overseas. Travel medical insurance pays for hospital visits, medicines, and emergency treatment. In serious cases, it can cover medical evacuation. That alone can cost tens of thousands of dollars. Travel insurance turns a stressful situation into a manageable one.

Quick Reference Guide

| Main Term | Travel Insurance |

| Purpose | Financial and medical protection during travel |

| Coverage Types | Medical, cancellation, interruption, baggage, delays |

| Ideal For | International travelers, families, seniors |

| Average Cost | 4% to 10% of trip cost |

| Coverage Duration | Single trip or annual |

| Purchase Time | Before or soon after booking |

| Key Benefit | Peace of mind and financial safety |

| Claim Method | Online or via insurer support |

| Global Acceptance | Widely accepted worldwide |

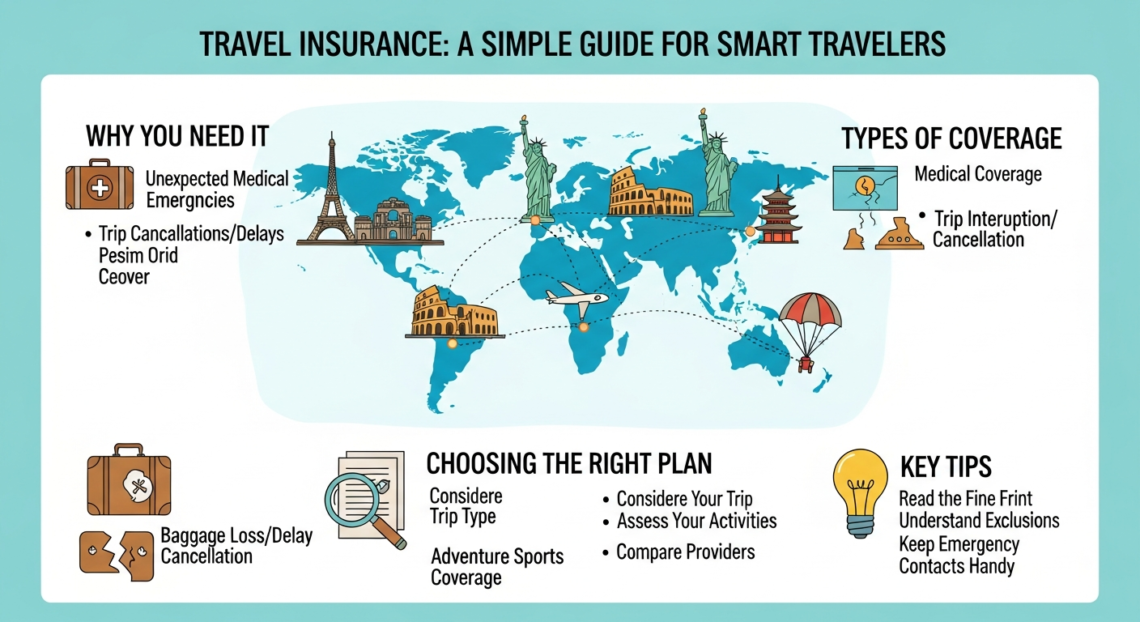

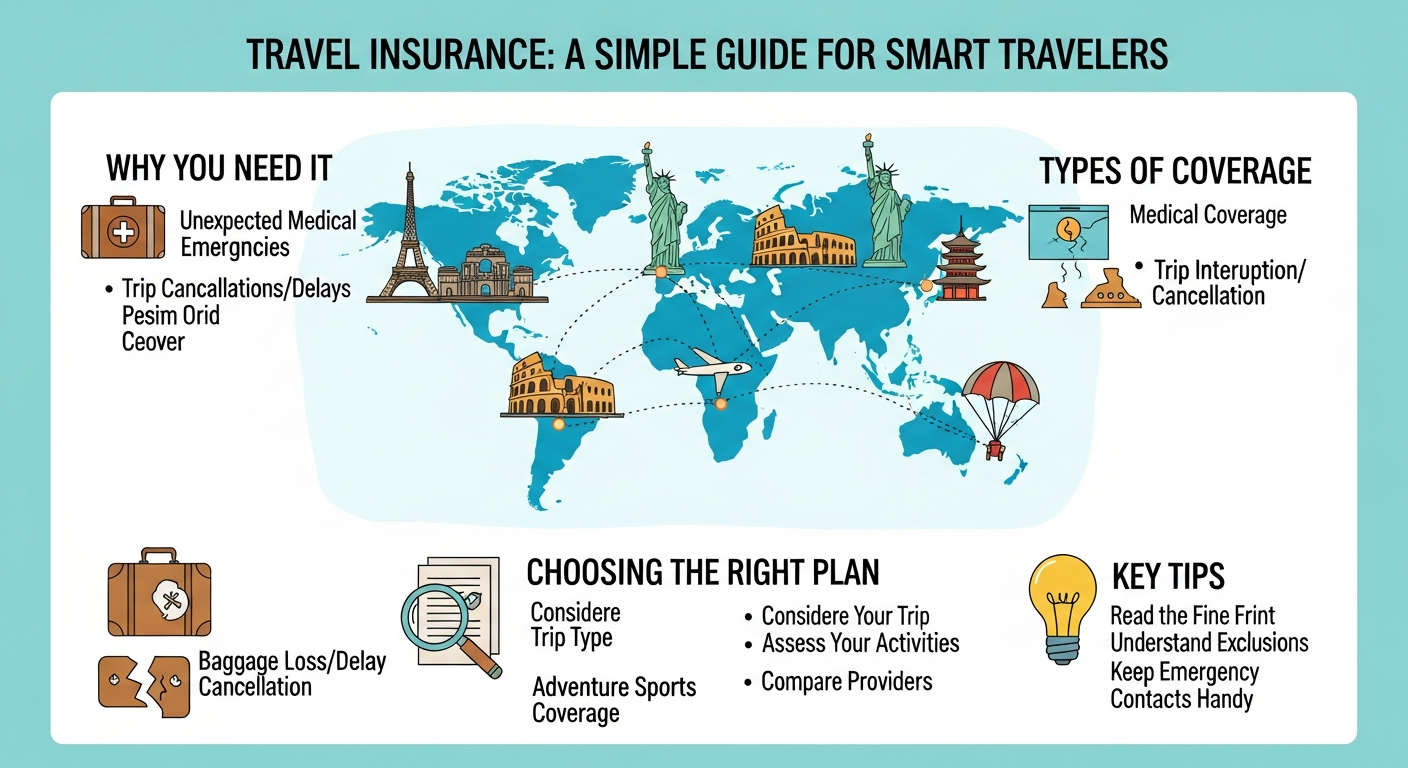

Types of Travel Insurance Coverage You Should Know

Travel insurance is not one single product. It includes different types of coverage. Trip cancellation insurance refunds prepaid costs if you cancel for covered reasons. Trip interruption coverage helps if you must return home early. Travel medical insurance covers health emergencies during your trip.

Other common options include baggage loss coverage and travel delay insurance. Some plans also include accidental death benefits. Comprehensive travel insurance combines many of these in one policy. Knowing these types helps you choose a plan that matches your trip and budget.

Travel Medical Insurance: Health Protection Abroad

Travel medical insurance is one of the most important parts of travel insurance. It covers doctor visits, hospital stays, and emergency care while traveling. Many countries require visitors to pay medical costs upfront. Without insurance, this can be very expensive. This coverage is useful for international travelers, seniors, and adventure tourists. Some plans include emergency medical evacuation. This means transport to the nearest suitable hospital or back home.

Trip Cancellation and Interruption Coverage Explained

Trip cancellation insurance protects your prepaid travel costs. If you cancel due to illness, injury, or family emergencies, you can get a refund. Covered reasons vary by policy. Always check what is included. Trip interruption coverage works during your trip. It helps if you must return early due to covered events. This type of travel insurance is valuable for expensive trips. Cruises, tours, and long vacations often have strict refund rules.

Baggage Loss and Travel Delay Insurance Benefits

Lost or delayed baggage is frustrating. Travel insurance helps replace essential items. Baggage coverage pays for clothes, toiletries, and personal items. If bags are permanently lost, it reimburses their value. Travel delay insurance covers extra costs when flights are delayed. This includes meals, hotels, and transport. These benefits are small but very helpful.

How Much Does Travel Insurance Cost

The cost of travel insurance depends on several factors. These include trip price, duration, destination, and age. On average, it costs 4% to 10% of your total trip cost. Comprehensive plans cost more but offer wider coverage. Cheap travel insurance plans exist, but they may have limits. Always compare coverage, not just price. The goal is value, not the lowest cost.

Common Travel Insurance Mistakes to Avoid

Many travelers make simple mistakes when buying travel insurance. One mistake is buying too late. Some benefits only apply if purchased early. Another error is ignoring exclusions. Not all situations are covered. People also assume everything is included. This is rarely true. Read the policy carefully. Do not rely on credit card insurance alone. It often has limited coverage. Avoid these mistakes to get full value from your travel insurance.

Frequently Asked Questions

Conclusion

Travel should be a source of joy and discovery, not stress and financial worry. Unexpected problems can arise at any time, but having the right travel insurance ensures that you are never left to handle them alone. By covering medical emergencies, trip cancellations, and logistical delays, insurance provides a comprehensive safety net for your investment.

Choosing a suitable plan is a mark of an experienced and responsible traveler. It allows you to explore the world with confidence, knowing that help is just a phone call away. Prioritize your peace of mind and make travel insurance a permanent part of your journey planning.